Trying to determine where to invest? Looking to drive top-line revenue? Can’t focus on what opportunities to pursue? Growth Mapping is an approach that clarifies unidentified or unrealized opportunities.

Growth Mapping is a service that we’ve seen deliver a business-changing impact for clients, and ironically, that’s what makes it the service we can talk about the least (at least openly.) As with most innovation work, Growth Mapping is highly strategic and thus kept confidential, which makes it difficult to demonstrate in action.

So, we identified a company we don’t work with to conduct an unsolicited Growth Map. While this is a somewhat lighter version of what we typically do (no primary research was conducted, no collaborative workshop, and the recommendations and next steps are intentionally high-level), the depth of analysis and overall rigor are consistent.

Want a deeper dive, including market and revenue modeling? Download the whitepaper.

We chose generative music startup Suno.ai for a Growth Mapping case study because they recently emerged from stealth and continue my other recent GenAI articles on feedback loops and music recommendation engines.

As a songwriter, I also have an informed perspective on the process Suno is trying to simplify. While that could potentially bias the analysis, I believe what follows is a fair assessment of where Suno finds itself and the options before the company as it tries to figure out the future of GenAI for music.

Suno Sample Growth Map

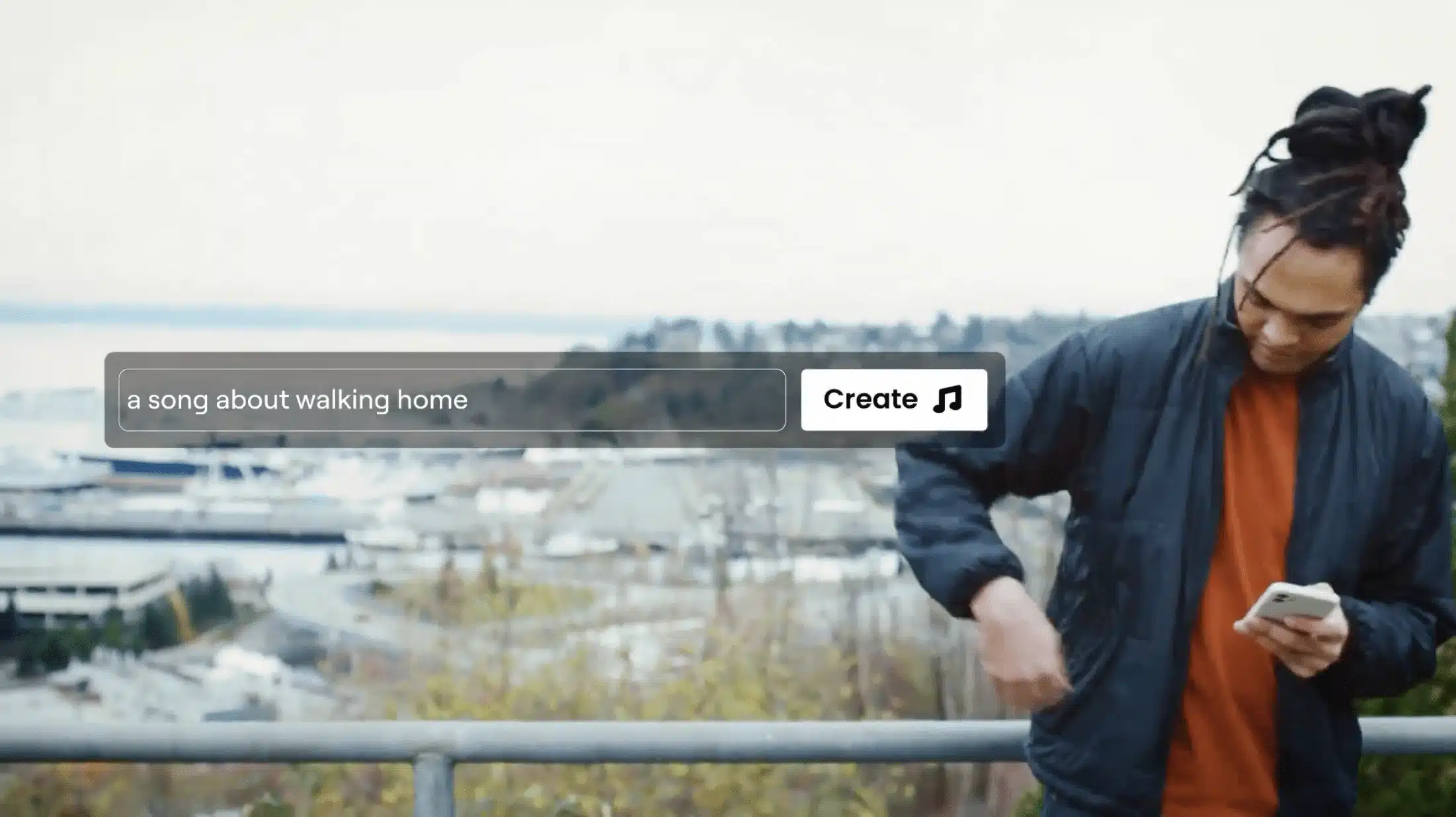

Generative AI startup Suno wants to make songwriting as easy as taking iPhone photos.

“Suno AI has come out of stealth with the aim of helping anyone write and create songs as easily as taking photos on a phone.”

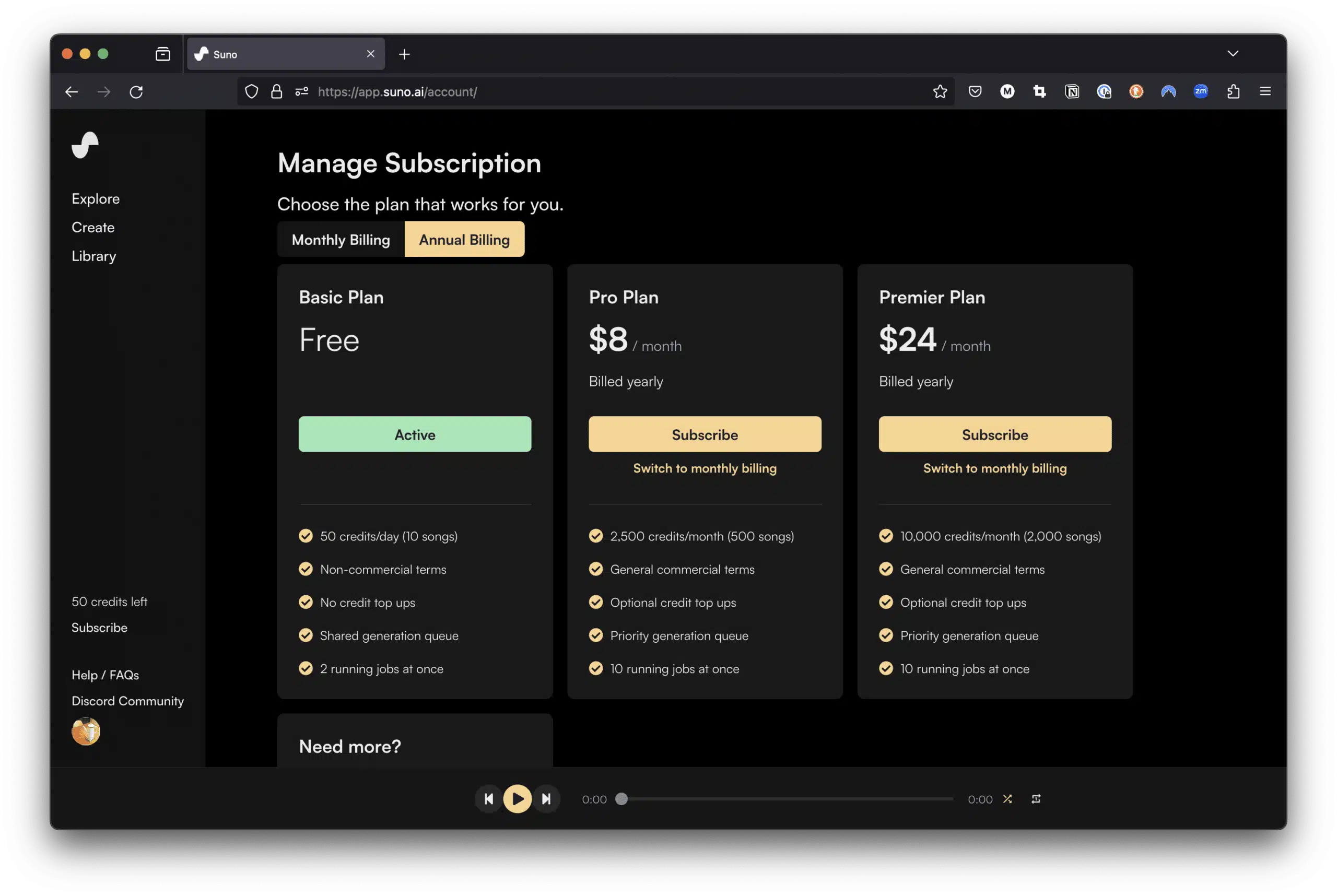

Suno.ai is an AI-powered generative music service that focuses on generating music with lyrics and vocals. Much like Midjourney, the GenAI tool for image creation, Suno originated on a Discord server and is a tiered SaaS product that offers subscriptions to computation credits that allow users to generate content.

Suno’s two paid tiers grant commercial rights, allowing the subscriber to profit from the generated outputs as pieces of music or embedded within other media.

The Suno interface is familiar to anyone who has tried GenAI tools: simply write your request and wait for the result. The scope of what can be requested is more or less hidden, though Suno does provide a “Custom Mode” that includes the fields Lyrics, Style of Music, and Title.

Whether 100% intentional or a by-product of generative music still being early, Suno’s focus on lyrics and singing constrains the product so that it simplifies the song generation process, making it accessible to a broader group of people. Whether that simplification matters to enough people to support Suno’s business is the bigger question we can aim to answer with our Growth Mapping exercise.

Defining Problems and Markets

Our current wave of AI, headlined by GenAI, is still in its early stages. Regardless of the accuracy of any projections here, it is important to look at what problem(s) it is best suited to solving to understand where AI is going. Or maybe, for the more optimistic, what is it enabling people to do that they otherwise couldn’t do before, and how valuable is that? What could people do with this technology that is gratifying, meaningful, or productive?

Suno appears to be deploying a copy-cat strategy–a company takes a successful model and applies it to an adjacent industry, market, or problem space. In other words, Suno is trying to be Midjourney for music. Midjourney generates an estimated $200M in annual recurring revenue. Surely songs could be as valuable?

Unfortunately, the value of their respective outputs (image vs sound) is so fundamentally different that it becomes difficult to see a similar path to market success by simply being early and following the Midjourney playbook.

The internet consumes and discards images in a fraction of a second. There is a never-ending supply of disposable visual content that exists purely to sustain attention until the next ad. Music is durational and can live, on loop, in the periphery of someone’s attention. And the value of music is directly tied to that pattern of consumption.

Music is an asset with the potential to generate a return well into the future because people return to it. Photos and other images (I will include video for social media purposes here) on the internet are largely discarded after a single use and thus pretty much worthless in and of themselves.

Since Suno monetizes each user by selling them compute power, it is locking itself into a volume game. It needs users to generate, consume, and ultimately discard more and more songs for its business to be successful.

That said, given where Suno is today and that GenAI is still very early, we use our Growth Map to explore what problems SunoI could solve. And what segment is sufficiently large to satisfy the volume demands of this business model?

Problem 1: On-demand personalized mood music

Could Suno give people exactly what they want to hear, when they want to hear it, better than any existing artist or algorithm?

Suno’s launch video makes this value proposition. A mass-market consumer offering would certainly achieve sufficient scale from a business perspective, and people do listen to A LOT of music (4.1T, as in trillion streamed songs in 2023).

However, that stream number comes with significant caveats. Most notably, of the 184M tracks available on streaming services, 24.8% (45.6M) had zero plays, 43% (79.7M) generated fewer than ten plays, and 86.2% (158.6M) failed to cross the 1000 yearly plays threshold.

For Suno to play in the 4.1T stream music market, they must steal share from the big winners, not just participate in the long-tail.

People listen to the winners over and over again. They don’t listen to an endless stream of unknown artists—which doesn’t bode well for one filled with AI-generated one-offs, which is what Suno’s product and business model wants users to do.

From a customer outcomes perspective, if a user generates a song they like so much that they listen to it on loop for a month, that month would be a commercial failure for Suno since that user would have no need for more songs and thus no need to subscribe. Because Suno sells songs as a proxy to compute time, it wants people to create more and more songs; it doesn’t need anyone to listen to them.

If the value proposition is about delivering a deeply personalized experience, is generating songs more likely to return a satisfying result than Spotify’s Discover Weekly? Could Spotify simply kill Suno by improving its search function and making it more GenAI-like? Isn’t one of the hypothesized future end-states of GenAI a better search?

Deploying a copycat strategy of “Midjourney for X” probably sounds good on paper, but in the consumer music market, it is hard to see a path to meaningful scale in terms of the volume of songs generated. A Suno hit song with millions of streams is as valuable as a song that was listened to once.

Problem 2: Ambition skill gap

Could Suno bridge the gap between someone’s musical ambitions and the reality of where they find themselves? Could users leverage Suno’s outputs to help them publish the music they aspire to create, be it through directly releasing the output or through re-recording and refining the tunes generated?

Suno aspires to make song creation as easy as taking a photo. It is estimated that, in 2020, the world posted 3.2 billion images of various internet services every day. In contrast, in 2023, it was estimated that 120,000 songs were uploaded to streaming services daily. That’s a difference of 26,667 times.

An argument could be made that the volume disparity is partly technology-driven, given the ubiquity of cameras in the world. But Suno would have to make a big assumption that there is a very large untapped market of aspiring songwriters to justify the equivalency they aspire to.

The reality is the demand for new images far outstrips the demand for new songs, even before you factor in how many songs go unheard on streaming platforms.

According to Spotify, “Of the nine million people who have uploaded any music to Spotify, 5.6 million have published fewer than ten songs all time — indicating that they may be very early in their journey, approaching music as a hobby, or not leveraging streaming as part of their career path.”

When considering that Suno would have a starting point of 9M artists, of which over half are either hobbyists (i.e. high churn) or retired, the obtainable market gets small fast. Based on the modeling (download the white paper for details), if Suno captured 100% of the artists who are generating royalty revenue from their music (1.051M) and had them subscribe for an entire year at $96, the TAM for that market would be $100.9M. Or $100M less than Midjourney earns in recurring revenue today. Simply put, this problem, and thus its market is too small for Suno’s ambitions.

Problem 3: Cheap and easy music rights

Could Suno offer a cheaper, easier, and more convenient method of sourcing music to accompany other media (video, video games, podcasts, etc)?

The first market outside of Suno’s initial targets that we’ll look at through our Growth Map is the Creator Economy. The problem underpinning this opportunity is Cheap and Easy Music Rights. It assumes that for creators who make content that includes music, Suno would provide a path to quality music without the headaches or long-term concerns of licensing original music.

It is estimated that there are 50M self-identified creators, of which 3.3M are professional, operating across multiple platforms (YouTube, Instagram, and TikTok being the most popular).

It immediately becomes clear that this market has a greater scale. There are 5.55x more creators than total artists on streaming services and 15x as many professionals, making it far more attractive to pursue.

The market is also relatively young and still growing, and new content is more valuable than older “catalog.”

Unlike songwriters, Creators can’t rest on the revenue generated by their 5-plus-year-old hit song. The need to regularly create is baked into the incentive structure. They need to satiate their audience with regular new material or risk losing them to other creators.

This pattern of creation and consumption aligns much better with how Suno is structured than the previous markets.

Consequently, the Creator Economy starts to look promising, as Creators don’t depend on their generated songs to earn revenue, yet still need music to support the content they produce.

A company already exists in this problem space: Epidemic Sound. In 2022, they generated $112M in revenue, of which $71M was from a subscription for creators similar to the one Suno offers. Based on the modeling in the full report, Suno would have to capture 1,59% of the creator market (797,000 subscribers) to generate $70+ million in revenue.

This is more promising than the songwriter market but would suffer from similar churn because nothing keeps creators on Suno after generating the songs they need beyond the need for more. The big question is: how much volume do creators need? 500 songs a month for the Pro plan is likely more posts than the creators make in a month.

If Suno wants to target this market, it will have to adjust its product to better match the needs and problems of Creators.

Problem 4: Honest Expression at a Safe Distance

Could Suno solve the problem of people being able to express how they feel but using AI-generated assets as a shield to protect their vulnerability?

In our Growth Map, I call this final market opportunity Meme Music because it is best aligned to the disposable consumption pattern of use Suno is chasing.

The critical distinction in contrast to the other markets is that the songs generated by Suno are worthless. So, instead of trying to build monetization infrastructure to extract outsized returns from worthless outputs, we must accept that Suno makes meme music: infinitely disposable sonic culture.

This market addresses two problems:

- Honest expression at a safe distance for social media users

- Cheap and easy music rights for social media platforms

As for the expression problem, music is social. When a song resonates with someone, it’s a really powerful thing, as though the artist can articulate how the listener is feeling in a way they cannot. This is one reason people include songs in their posts: the inclusion says something they don’t have to say themselves.

This is where the real power of Suno could lie: it’s not the music generation that’s most valuable, but the lyrics used to generate the voice. Whether supplied by the user or generated via prompt, the control over the lyrics gives people a simple way to express themselves in a medium that can otherwise be challenging.

Meme Music also addresses the cost of licensing original music. Social media platforms that rely on user-generated content must pay royalties to right holders when commercially protected content appears on their platform. These platforms strike deals with labels and publishers that allow copyrighted content to be used on the platform in exchange for a fee. Sometimes, that fee is paid on a play-by-play basis (YouTube, which paid $4B in 2021). Sometimes, there is a blanket payment (a “blind check”) every year to cover estimated usage (TikTok, which paid an estimated $179M in 2021).

In both examples, music royalties are viewed as a cost of doing business, and one both businesses believe is worth paying to drive the use of their core product. If they could achieve a similar or better level of engagement by eliminating some of this cost, it would be prudent to explore that possibility.

If we use the estimated $179M in royalties TikTok paid against its $4B in revenue in 2021 and apply the same percentage against its estimated $4B in revenue for 2022, TikTok would have paid $540M to rightsholders.

If Suno functionality was embedded in TikTok and could reduce the number of posts that included rights-protected music by 10%, that would represent a potential $54M savings per year. That number is already a quarter of Midjourney’s ARR without dealing with subscriber acquisition and churn.

A free feature that offers TikTok differentiation and significant potential cost-savings, all while satisfying a key use case of the current product, represents the kind of problem-solution fit that warrants further exploration and validation.

Suno’s recent “Make a song for your Valentine” feature could represent an in-market experiment in this direction, as opposed to the seasonal marketing gimmick it was clearly conceived to be. With the help of a little fill-in-the-blank mad-lib, Suno’s Valentine’s Day promotion generates a love song for its users and helps them share it with that special someone. This isn’t serious music. And it’s not content for creators. This is an expression helped by AI. This is exactly what it would entail for Suno to fully embrace Meme Music as its primary value driver.

Putting a Growth Map in Action

Growth Mapping helps clients understand their options so they can make better, more strategic decisions about where to invest. The first such investment would be to design and execute the right experiments to prove whether the assumptions underlying the product and market are true. For a deeper dive into Suno’s opportunities, download our whitepaper.

Running Suno and its product through a slightly narrower version of Growth Mapping demonstrates how the service works and the importance of understanding the problem and market you are entering before you develop your product, not afterwards.

Suno is a great example of technology and hype in search of a problem and market. While I believe their initial Midjourney copy-cat strategy is likely to be invalidated, our Growth Mapping exercise clearly shows other segments with problems that Suno could genuinely help solve.

The long-term value of the music Suno users produce is pretty much nil. Suno has priced it such. However, the momentary value of a quick, easy, and safe vehicle for expression is not nothing. And what industry monetizes such expression the best? Social media. So, is Suno a social network? No. I think the ultimate end state for Suno is as a feature inside an existing social network, with TikTok being the best fit. Especially since Universal Music Group pulled all their music from the platform, Suno could fill that gap and help TikTok save money in the process.

As a songwriter, I’m not particularly threatened or inspired by Suno. Sure, in the TikTok scenario, it would take money away from artists. Still, of the financial problems facing artists today, AI-generated meme music would be pretty low on the list, in my opinion.

As Francois Chollet of Google said about LLMs: “Memorization works, as long as you don’t need to adapt to novelty.” GenAI works through the memorization of a vast body of data. Because it can access it all at any time, it can generate seemingly new outputs. However, responding to human novelty demands a volume of examples such that the novel would, by necessity, be common. A song that truly resonates with the listener is an uncommon thing. And more magical than any AI.